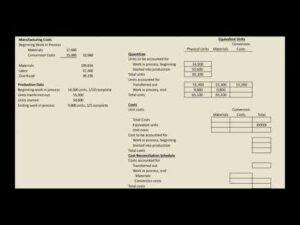

Your tax return from last year provides an accountant with a good foundation for where to start preparing your new return. Organizing your financial information is crucial for several reasons. First, it can help you keep track of your expenses and income, which is essential for https://kelleysbookkeeping.com/ preparing your tax return accurately. Additionally, it can help you avoid penalties and fines that can result from missing deadlines or failing to report income correctly. Finally, it can help you identify areas where you can save money and optimize your business operations.

Your due diligence doesn’t end after you pick a tax preparer. Watch out for warnings signs that something isn’t quite right. If one of these “red flags” pop up, you should seriously consider switching to another preparer right away. Is a good place to start if you want to check up on a preparer’s reputation.

Refunds

Regardless of whether you are an individual or a small business, we will help you plan, prepare, and file your taxes. Planning for your taxes can be confusing and daunting, especially if you are trying to set yourself up for success and aren’t sure where to start. We can help you maximize your return, understand what you need to anticipate come tax time, and how to best prepare yourself.

- In small business accounting, an accountant helps you understand your financial health and make strategic financial decisions.

- Having a licensed CPA discuss your tax return with the IRS is likely a better option than you doing it alone.

- Tap into a team of experts who create and maintain timely, reliable, and accurate resources so you can jumpstart your work.

- From our example above, Jason has a very ordinary return at age 25, meaning his chances of being audited are pretty low.

If you’re not sure you’re doing them right or you really don’t want to represent yourself in an audit, you should hire a CPA to take care of it for you. They’re not afraid of the IRS, and they can confidently handle your case and explain in layman’s terms what’s actually going on. A CPA can also help you do some tax planning to reduce your taxable income for next year.

How to Really Find a Great Tax Accountant

Although all CPAs meet substantially the same education, training, and licensing requirements, they do not all provide the same range of services. Therefore, when looking for a CPA, you should analyze your current and future financial needs and select someone who can address your particular concerns. Avoid those who claim they can obtain larger refunds than other preparers or those who “guarantee” results. Can you provide me with the names of references I can contact about the quality of your work? Think about checking with the Better Business Bureau in your area for complaints about the services provided by the preparer.

Ask yourself as many questions as you need to make sure you prioritize your needs when deciding on the right accountant. Available only at participating H&R Block offices. H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status.

More resources for finding tax professionals

How long can you expect to wait before you get a response? Do you need a full-time accounting service available around the clock? Think about how much and what kind of communication will be most comfortable for you. You may already know that the accountant has some experience with your industry, but how much? You probably don’t want to be their very first client as they open a new shop. If your accounting prospects are members of one or more professional organizations, the organization has done a bit of the vetting for you.

- You can even ask the prospective accountant to share a list of clients with you to make sure they are a right fit.

- He quit his job to start his own architecture firm, which has done quite well.

- Tax time is often when people start thinking about whether or not they need a CPA, although there are so many other reasons to seek out a CPA.

- For people with simple tax returns or more time than money, it makes sense to use TurboTax or some other tax preparation software to file their taxes.

- Tax accountants usually have different fee structures, so don’t be shy about asking how they’ll charge you for their services.

For many, hiring a CPA is a wise choice to ensure that you take advantage of every tax deduction that you’re eligible for. If you fall into that category then you may want to consult with a financial advisor to help you make the right tax choices. Many CPAs hold the Personal Financial Specialist credential, which signifies additional expertise in the area of personal finance. If you’re looking for year-round conversations that go beyond just taxes for proactive planning toward reaching your personal life goals, a CPA/PFS may be the expert you seek.

3 The Annual Percentage Yield (“APY”) for the Lili Savings Account is variable and may change at any time. The disclosed APY is effective as of March 28, 2023. Available to Lili Pro, Lili Smart, and Lili How To Find A Good Cpa For Your Taxes Premium account holders only. Armed with some good background information, you’re ready for some conversations. Try to book a call with at least three candidates so you have several points of comparison.

- Your accountant knows the ins and outs of your finances and can help you plan for your future, set yourself up for success, and walk you through navigating fiscal pitfalls.

- DOR grants allow these clinics to provide more assistance with state-specific tax issues.

- There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials, which may be non-refundable.

- At Adam Valdez CPA PLLC, we want your taxes to be as easy to understand as possible.

Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting. If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. Tax returns may be e-filed without applying for this loan. Fees for other optional products or product features may apply. DE, HI and VT do not support part-year/nonresident individual forms.